Changes from container shortages to container surpluses in China

The last two years featured supply-chain disruptions, limited shipping capacity, and remarkably high container rates. But 2023 will be rather different.

Empty containers are piling up in many Chinese ports. The main reason is the drop in global demand that has continued since mid-2022, which has caused many empty containers that were supposed to end up in other countries to return to China. Port operators are stressed by the increasing challenges of storing empty containers.

Trailer drivers in several ports estimate that the volume of goods will increase before the Chinese New Year, but this year has not brought as many orders as expected.

A shortage of containers has entirely reversed into a glut as crashing shipping rates and canceled sails gain momentum during what is supposed to be the busiest shipping period of the year.

A quiet market and volume weakness across all trade lanes has led to empty containers piling up in Chinese ports.

The declining rates and container prices indicate a weakening demand and surplus of containers. The wider this gap, the lower the container rates and prices.

Challenge on sea freight charge

Reductions in sea freight rates

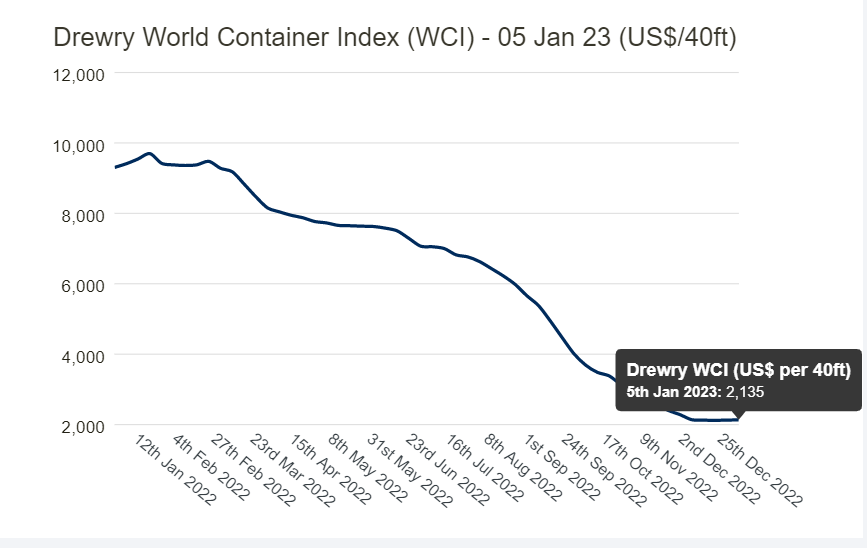

World Container Index – 05 Jan 2023

Drewry’s composite World Container Index decreased by 0.3% to $2,119.96 per 40ft container for the week of December 22.

Rates are now 27% lower than the 10-year average of $2,692, indicating a return to more normal prices. But even so, rates are still 49% higher than the average 2019’s pre-pandemic rate of $1,420.

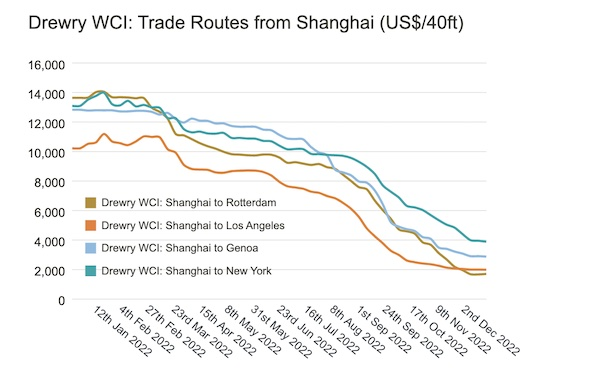

Rates from Shanghai to Los Angeles fell 1% to $2,039. Shanghai to New York saw a much steeper drop of 9%, but the route remains significantly higher than rates to the West Coast at around $4,408 per container.

The average composite index for the year-to-date is $6,461 per 40ft container, which is $3,768 higher than the 10-year average ($2,693 mentioned above).

The composite index decreased by 0.3% to $2,119.96 per 40ft container and is 77% lower than the same week in 2021. Freight rates on Shanghai – New York dropped 2% or $63 to $3,889 per feu. Spot rates on Shanghai – Genoa and Los Angeles – Shanghai fell 1% each to $2,879 and $1,169 per 40ft box, respectively. Similarly, rates on Rotterdam – Shanghai, and Rotterdam – New York slipped 1% each to $789 and $6,989 per 40ft container, individually. However, rates on Shanghai – Rotterdam gained 2% or $32 to $1,706 per feu. Rates on New York – Rotterdam and Shanghai – Los Angeles hovered around the previous week’s level. Drewry expects smaller week-on-week reductions in rates in the next few weeks.

Source: World Container Index, Drewry Supply Chain Advisors

Container spot rates started to slip in early 2022 and their descent accelerated in the second half of the year. The World Container Index compiled by London-based Drewry Shipping Consultants is down 77% so far this year. And it may slide further still—signaling the end of a record earnings run for shippers. Rates are now not far above pre-pandemic levels.

Shipping company profits remain strong thanks to high freight rates signed in early 2022. However, rates in new contracts in 2023 are expected to fall significantly. Compared to 2022, it is estimated that the profits of shipping companies will fall by 70-80%. Thus, the highly profitable period of sea shipping is coming to an end.

New ship capacity

A price war among shipping companies is looking more likely in the 2023 year: Slowing growth amid high inflation and interest rates in the U.S. and an energy crisis in Europe may culminate in recession. And the demand cliff comes as the shipping industry is also preparing for a massive delivery of new vessels.

Drewry expects 2023 will witness the largest-ever addition of new ship capacity—about 2.5 million twenty-foot equivalent units (TEU) unless some deliveries are deferred. Shipping companies will struggle to manage a simultaneous decline in global trade and a surge in ship supply unless they can form alliances to curtail sailings, sell excess capacity and convince clients to sign long-term contracts.

Labor shortages and material shortages

Labor shortages and material shortages will continue to challenge the transport sector in 2023. Strikes for higher wages and better working conditions took place in all parts of the world last year—a situation that could worsen with the war in Ukraine. At 10.5 percent and 4 percent, respectively, Russia and Ukraine supply significant shares of the world’s sailors. If Russia announces a full mobilization, the shortage of deckhands could intensify.

Rules on ship carbon intensity and rating system enter into force

IMO regulations to introduce carbon intensity measures entered into force on 1 November 2022.

Amendments to the International Convention for the Prevention of Pollution from Ships (MARPOL) Annex VI entered into force on 1 November 2022.

From 1 January 2023, it will be mandatory for all ships to calculate their attained Energy Efficiency Existing Ship Index (EEXI) to measure their energy efficiency and to initiate the collection of data for the reporting of their annual operational carbon intensity indicator (CII) and CII rating.

The amendments to MARPOL Annex VI are in force from 1 November 2022. The requirements for EEXI and CII certification come into effect on 1 January 2023. This means that the first annual reporting will be completed in 2023, with initial CII ratings given in 2024.

How will the impact of the new regulations be assessed?

IMO’s Marine Environment Protection Committee (MEPC) is to review the effectiveness of the implementation of the CII and EEXI requirements by 1 January 2026 at the latest and develop and adopt further amendments as required.

In adopting the measure, MEPC also considered the outcomes of a comprehensive impact assessment of the measure which examined potential negative impacts on States and agreed to keep the impacts on States of the measure under review so that any necessary adjustments can be made. MEPC also agreed that disproportionately negative impacts of the measure should be assessed and addressed, as appropriate.

Source: www.imo.org

China’s downgraded COVID-19 response measures and fully open in 2023

China will be fully open in 2023

China has optimized immigration administration policies and measures starting from Jan 8, 2023, in compliance with the country’s downgraded COVID-19 response measures.

China’s National Health Commission (NHC) announced on Dec.26th that the country will downgrade its level of COVID-19 management from the current Class A to a less strict Class B starting from Jan. 8, 2023.

After three years, China announced its reopening. Passengers can enter China without quarantine. All you need is a negative PCR result within 48 hours before departure. You do not need to apply for a health code.

With the flow of people and the exchange of goods to be further facilitated, the new policies are set to gradually revive business activities across a wide range of sectors, including consumer spending, investment, and foreign trade.

Sources:

https://english.news.cn/20221227/0f5ffdc62cd841af8c274be6b16264e7/c.html

COVID-19 has spread rapidly

Since then, COVID-19 has spread rapidly and it is estimated that nearly 300 million people are now infected. Many workers are sick at home, and factories and logistics companies are experiencing labor shortages. The situation is expected to normalize gradually by the end of February and the beginning of March 2023. As Chinese New Year approaches, there may be challenges in China’s exports, importers suggest placing orders in advance to avoid delays.

Adjustment of tariffs signals further opening-up to the world

The Customs Tariff Commission of the State Council, China’s Cabinet, recently said the country has decided to adjust its tariff plan for 2023 and expand the number of tariff items in line with the need for industrial development and technological advancement.

By 2023, the country’s average tariff will fall to 7.3 percent, a drop of 2.5 percentage points in the past 13 years.

The latest tariff adjustment is a routine action, but the lower tariff rates China is expected to impose on more imported goods in the next few years will benefit more countries and groups.

Source: https://english.www.gov.cn/statecouncil/ministries/202212/29/content_WS63ad9ddac6d0a

Written by Judy Du

Judy@yhfloors.com